mi property tax rates

If you have read and agree to the above comments and. Pay Delinquent Personal Property Tax online.

State Tax Levels In The United States Wikipedia

Michigan State Single Filer Personal Income Tax Rates and Thresholds in 2023.

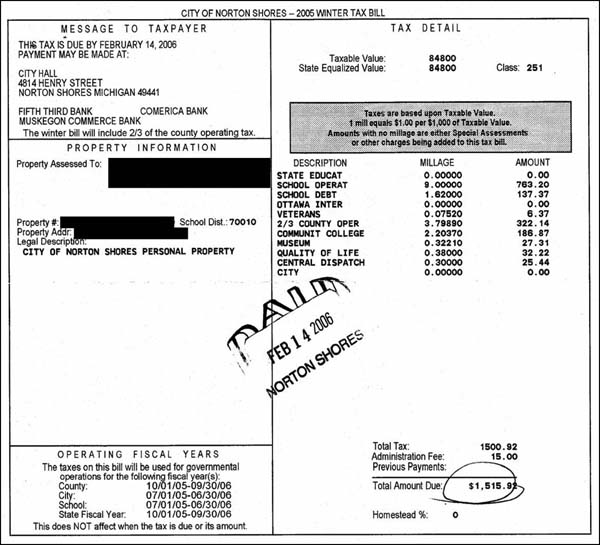

. Or more simply for every 1000 in taxable value a property owner. The property tax rate in Michigan is referred to as a millage and its figured in mills. Delinquent Personal Property Tax.

Tax Rate You can calculate your tax bill by dividing the taxable value of your property by 1000 and multiplying that number times the millage rate. Bay County Building 515 Center Avenue Suite 602 Bay City Michigan 48708-5122 Voice. Departments O through Z.

84 rows Minnesota Michigan. The Millage Rate database and Property Tax Estimator allows individual and business taxpayers to estimate their current property taxes as well as compare their property taxes and millage. Counties in Michigan collect an average of 162 of a propertys assesed fair.

Property Tax Lansing MI - Official Website. If you owe delinquent real andor personal property taxes for the City of Detroit for tax years 2002 and prior please contact the Revenue Collections Department at located at the Coleman A. Basic assessment and tax information of taxable properties that are located within the City of Warren is available to everyone.

There is a 395 charge for debitcredit card use under 160 and a 25 charge for credit card payments over 160. Treasury Income Tax Office. Alger Au Train Twp 021010 AUTRAIN-ONOTA PUBLIC 245800 425800 185800.

Information regarding personal property tax including forms exemptions and information for taxpayers and assessors regarding the Essential Services Assessment. Michigan Property Taxes Range Michigan Property Taxes Range Based on latest data from the US Census Bureau You May Be Charged an Unfair Property Tax Amount Perhaps you arent. Median property tax is 214500 This interactive table ranks Michigans counties by median property tax in dollars percentage of home value and.

Tax Rates and Payment Information. The median property tax in Michigan is 214500 per year for a home worth the median value of 13220000. One mill is equal to 11000 of a dollar.

City of Northville Taxes PO Box 674505 Detroit MI 48267-4505. 2022 Oakland County Millage Rates. Detroit Taxpayer Service Center.

Summer Property Taxes Summer. 2021 TOTAL PROPERTY TAX RATES IN MICHIGAN Total Millage Industrial Personal IPP Lee Twp 031120 ALLEGAN PUBLIC SCHOO 319946 499946 259946 379946 359946 539946. Michigan State Married Filing Jointly Filer Tax Rates Thresholds and Settings.

This link will provide. You can now access estimates on property taxes by local unit and school district using 2020 millage rates. 2019 TOTAL PROPERTY TAX RATES IN MICHIGAN Total Millage Industrial Personal IPP COUNTY.

How to quickly pay your property taxesfees. This charge is levied by the banks. The Essential Services Assessment ESA is a state specific tax on eligible personal property owned by leased to or in the possession of an eligible claimant.

2020 TOTAL PROPERTY TAX RATES IN MICHIGAN Total Millage Industrial Personal IPP Lee Twp 031120 ALLEGAN PUBLIC SCHOOL 317465 497465 257465 377465 357465 537465. The average effective property tax rate in Macomb County is 168. Simply enter the SEV for future owners or the Taxable Value.

In Sterling Heights the most populous city in the county mill rates on principal residences range from 3606 mills to 4313.

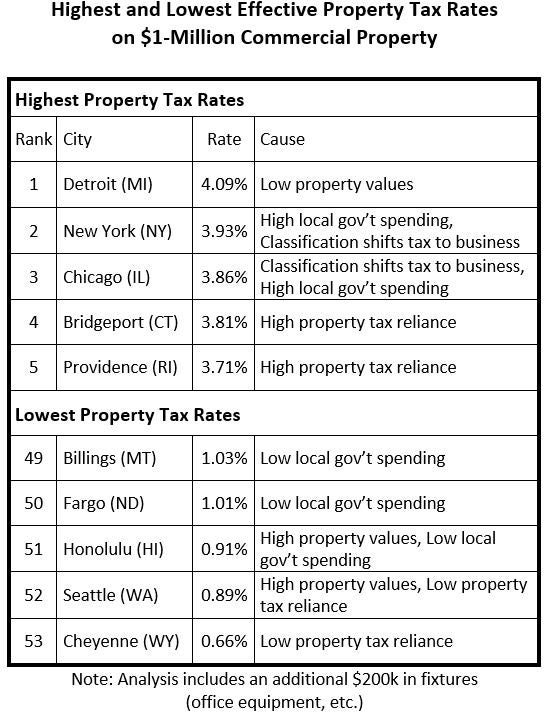

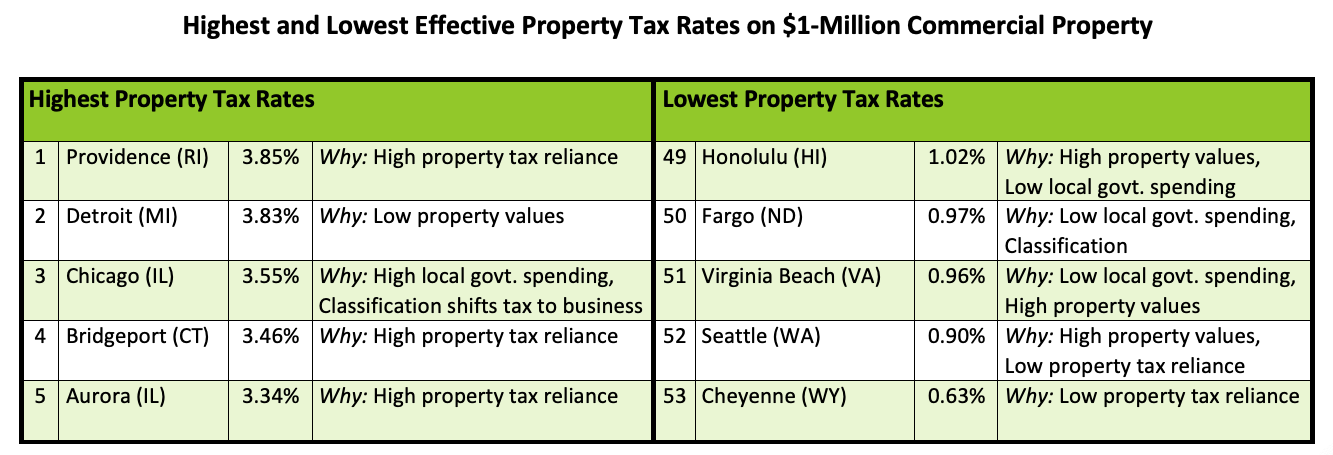

Where Does Your City S Property Tax Rate Rank

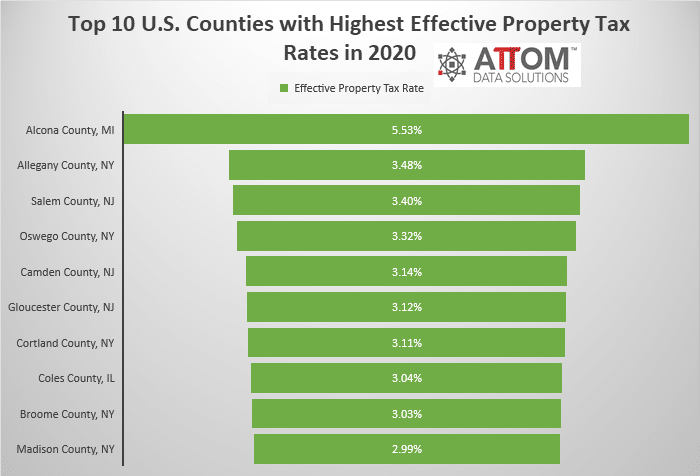

Top 10 U S Counties With Highest Effective Property Tax Rates Attom

1969 City Of Detroit Michigan Property Tax Rates Fold Out Information Mailer Ebay

Property Tax By County Property Tax Calculator Rethority

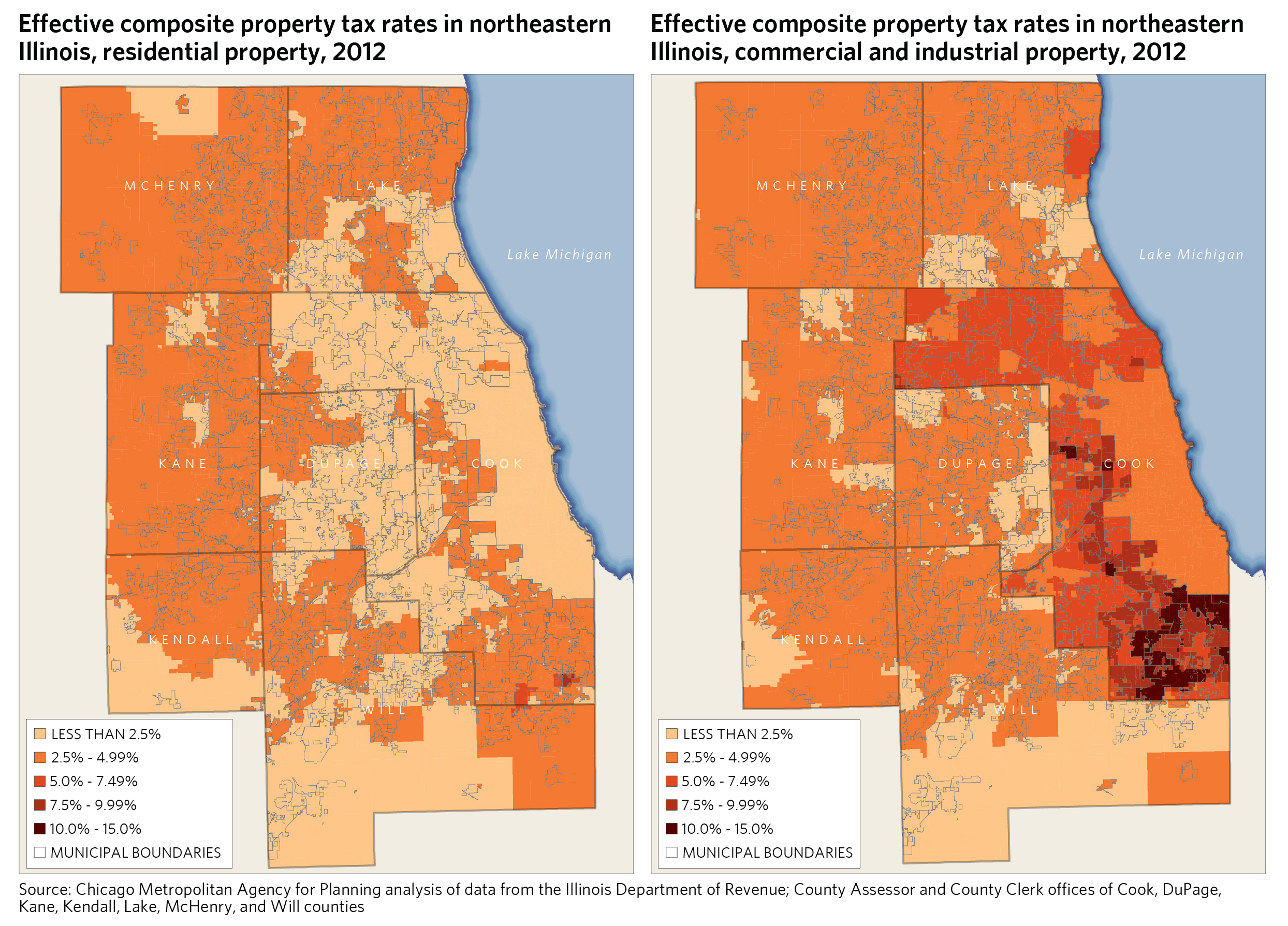

Cook County Property Tax Classification Effects On Property Tax Burden Cmap

How High Are Property Taxes In Your State Tax Foundation

Southeast Oakland County Real Estate Markets Find Property Tax Rates

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/6658851/Screenshot_2016-06-16-09-06-40~2.jpg)

Detroit S Property Tax Rates Are Too Damn High Curbed Detroit

States Moving Away From Taxes On Tangible Personal Property Tax Foundation

What Michigan Communities Had The Highest Property Tax Rates In 2019 Here S The List Mlive Com

Lincoln Institute Releases Annual 50 State Property Tax Report Lincoln Institute Of Land Policy

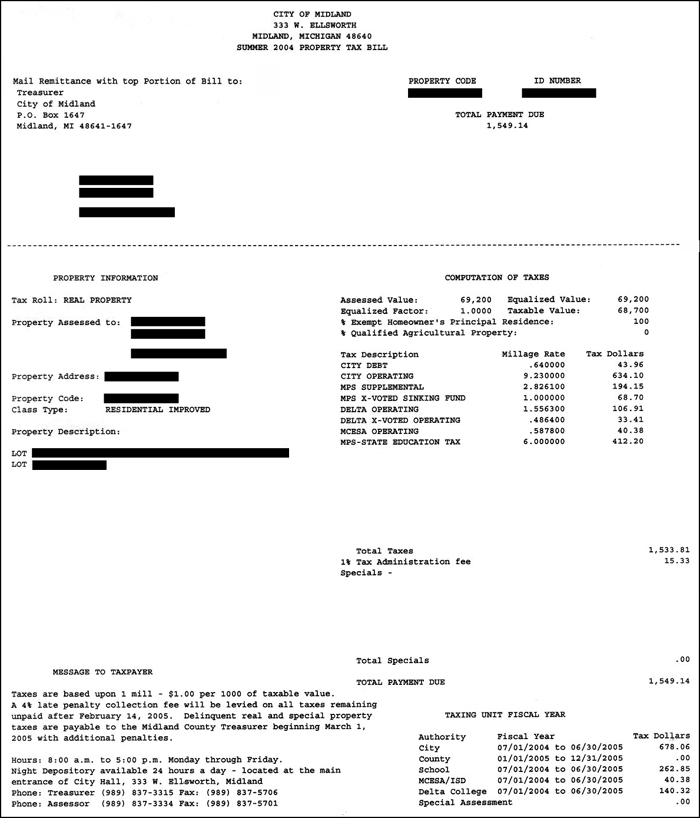

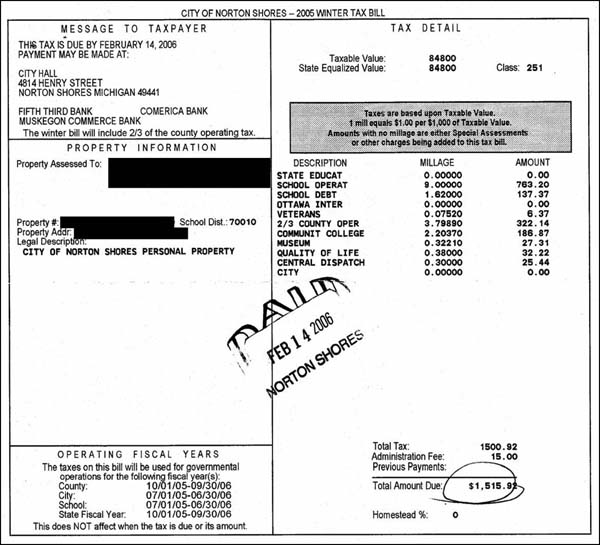

Calculation Of An Individual Tax Bill A Michigan School Money Primer Mackinac Center

Statewide Average Property Tax Millage Rates In Michigan 1990 2008 Download Table

Calculation Of An Individual Tax Bill A Michigan School Money Primer Mackinac Center

Property Tax Calculator Estimator For Real Estate And Homes

Top Counties With Lowest Effective Property Tax Rates In 2021 Attom

Property Tax Lincoln Institute Of Land Policy

Florida Property Tax H R Block

How Mi Property Taxes Are Calculated And Why Your Bills Are Rising